Ad Blocker Detected

Our website is made possible by displaying online advertisements to our visitors. Please consider supporting us by disabling your ad blocker.

CNN

—

CNN Underscored assessments fiscal goods these kinds of as credit playing cards and financial institution accounts based mostly on their over-all value. We might acquire a fee from Experian if you signal up for Experian Boost by means of the links on this web site, but our reporting is often independent and aim.

Possessing a excellent credit rating rating is critical, considering the fact that a robust rating can give you entry to the really finest financial loans, home loans and credit score cards. But what if your credit history score isn’t extremely great? Or you have a limited history with credit? Lenders can be unwilling to approve persons with poor credit scores for new credit score playing cards or financial loans, which can make it even tougher to construct — or rebuild — your credit score history.

While there are a good deal of “credit repair” providers that claim to fix your credit rating, they can be highly-priced, and it is not generally apparent which types have a fewer than stellar keep track of record. Having said that, there’s a somewhat new way to possibly increase your credit history scores in just a several minutes — and it is free.

The characteristic is referred to as Experian Boost™*, and it is certainly legit. In truth, Experian® is a single of the 3 primary credit history reporting companies in the United States and has been in business enterprise for around 20 years, so it has a good deal of working experience with credit rating scores. But does Experian Enhance basically improve your FICO® Rating**, which is used by 90% of top rated loan providers? Let’s choose a glance.

Experian Strengthen is designed to support give persons credit in which credit rating is due. By delivering your details to Experian, you can get credit for on-time payments that aren’t generally part of your credit history historical past, this kind of as utility, telecom, cable and some streaming support payments.

On-time payments account for 35% of your FICO® Score, so if you’ve been on the ball in paying your utility payments, cellular phone expenditures and even your Netflix® streaming support payments just about every month, you can include them to your credit history report and probably raise your FICO Score***.

Related: What’s a superior credit history rating?

When you entry Experian Strengthen, it permits you to link your checking, cost savings and other financial institution or credit score card accounts that you use to shell out your month to month expenditures so that your payment heritage can be extra to your Experian credit history file.

As extensive as you have at minimum three consecutive months of payments inside of the last 6 months from the exact same account, Experian Boost will select up optimistic payment activity and increase it to your Experian credit rating file. Ideal of all, it won’t report adverse payments — only these that were compensated on time.

Click on in this article to increase your credit scores for free with Experian Raise.

The Enhance system is rather straightforward and usually takes just a number of minutes. Just after creating an Experian account, you then url your economical institutions where by you retain your examining, discounts or other bank or credit card accounts that you use to fork out your costs, and enter your login credentials to seamlessly url them.

If you have several accounts at the same monetary establishment, Experian enables you to find which accounts you want included so you can just add the accounts you use to spend your payments.

When you have joined your accounts, Experian will immediately go through all your latest transactions and recognize payments that qualify to be additional to your Experian credit rating file, such as utility payments. It then demonstrates you a record of eligible charges and will allow you to find which kinds you want to insert to your report.

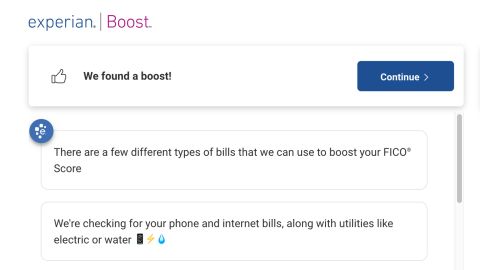

Experian

Experian Strengthen keeps you educated as it lookups for likely payments that can increase your credit scores.

Make your alternatives and inside times, Experian Boost factors in the new details and reveals you your new (with any luck , enhanced) FICO® Score. Considering the fact that Experian Enhance does not consist of skipped payments, your FICO Rating won’t go down, but it might not transform if there either is not enough information from the additional accounts or your FICO Rating is currently comparatively large.

Even if it does not make a variance to your FICO® Rating, the approach is as simple as it sounds and actually fees practically nothing. And as soon as you have it all set up, Experian Improve will go on to observe your payments, and may perhaps improve your credit scores if long term payments make a variance.

Use your on-time payments to increase your credit scores with Experian Increase.

It relies upon. In accordance to Experian, US end users have boosted their FICO® Scores by near to 45 million factors, and the regular FICO Score has amplified 12 points when working with Experian Strengthen. Those with minor to no credit score heritage and those people with incredibly weak to reasonable credit score typically see the most significant FICO Rating boosts.

We tried out Experian Boost ourselves and found the process to be quite straightforward, but we didn’t see any enhance in our credit scores. That is possible since the CNN Underscored reviewers who experimented with it now pay their costs on time and have superior credit score scores to start out with.

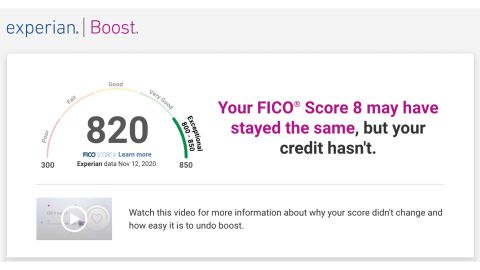

Experian

Our reviewers failed to see any improve to our FICO® Score with Experian Improve, but men and women with very little to no credit rating heritage and individuals with very weak to truthful credit usually see the greatest improves.

But people today who fork out their charges by their bank account and never have a longstanding credit history card or financial loan record could see a bigger effect. That’s mainly because you are going to start off to fill in your “payment history” element of your FICO® Score, which is one particular of the most significant factors in a credit score rating.

There aren’t genuinely any accurate shortcomings of Experian Strengthen — the worst that can come about is it doesn’t improve your FICO® Rating. It does not cost anything, and it will not hurt your credit score, so the only detail you could drop is a number of minutes of your time to established it up. The Experian membership also supplies your FICO Score for free on an ongoing foundation, which is valuable to have as you get the job done to improve your credit rating.

However, there are a few caveats to retain in intellect. Very first, Experian Increase only adds these positive payments to your Experian Credit Report — it just can’t include any information and facts to experiences from other credit organizations, this sort of as Equifax or TransUnion. So if you apply for a credit history card and the loan company pulls your credit score report from another bureau, the loan company will not see boosted credit score scores.

Connected: Does opening a new credit score card damage your credit score rating?

You are going to also uncover that the resource doesn’t function for payments that aren’t in your identify, even if you contribute to them. For instance, if you are living with roommates and send your part of the fuel invoice to your roommate via Venmo or PayPal, or give them a look at or funds, Experian Boost won’t decide up people payments.

At last, some persons are not snug delivering their lender login to a third get together. According to Experian, when you use Experian Enhance, Experian only utilizes your lender credentials to seize your ongoing good payments and determine any prospective new boosts.

For more defense, Experian also can make positive the title and tackle on your financial institution account matches what is on your Experian membership profile. Continue to, if you’re involved about privacy, you may well make your mind up that the upside of Experian Raise isn’t really worth handing about your particular data.

iStock

If your FICO® Rating could use some assist, there is basically no draw back to attempting Experian Improve.

Frankly, sure, particularly if your credit score scores could use some assist. Not everyone’s FICO® Score will maximize with Experian Raise, but the service is free, and it only normally takes a number of minutes to enter your details and link your accounts. There’s extremely tiny downside to working with the characteristic, and you can normally take away the added payment history from your Experian credit score file down the line if you want.

The greatest way to permanently enhance your credit rating scores is to methodically whittle down your personal debt by spending your financial loans, mortgages and credit history card expenses on time just about every month. But that system can just take time, so in the interim, test potentially supplying your credit rating scores a tiny enhance for free of charge with Experian Boost.

Understand far more about improving your credit score scores with Experian Boost.

*Benefits may well fluctuate. Some may possibly not see enhanced scores or acceptance odds. Not all creditors use Experian credit data files, and not all loan providers use scores impacted by Experian Increase.

**Credit score score calculated dependent on FICO® Rating 8 design. Your lender or insurer may perhaps use a distinct FICO Score than FICO Score 8, or an additional variety of credit history rating entirely. Study far more.

***Experian and the Experian emblems utilized herein are emblems or registered logos of Experian and its affiliates. The use of any other trade name, copyright or trademark is for identification and reference reasons only and does not suggest any affiliation with the copyright or trademark holder of their products or brand. Other merchandise and enterprise names pointed out herein are the house of their respective owners.